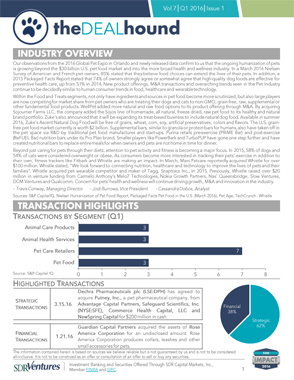

Industry Overview

Our observations from the 2016 Global Pet Expo in Orlando and newly released data confirm to us that the ongoing humanization of pets is growing beyond the $30-billion U.S. pet food market and into the more broad health and wellness industry. In a March 2016 Nielsen Survey of American and French pet owners, 85% stated that they believe food choices can extend the lives of their pets. In addition, a 2015 Packaged Facts Report stated that 74% of owners strongly agree or somewhat agree that high-quality dog foods are effective for preventive health care, up from 51% in 2014. New product offerings, M&A transactions and overarching trends seen in the Pet Industry continue to be decidedly similar to human consumer trends in food, healthcare and wearable technology.

Our observations from the 2016 Global Pet Expo in Orlando and newly released data confirm to us that the ongoing humanization of pets is growing beyond the $30-billion U.S. pet food market and into the more broad health and wellness industry. In a March 2016 Nielsen Survey of American and French pet owners, 85% stated that they believe food choices can extend the lives of their pets. In addition, a 2015 Packaged Facts Report stated that 74% of owners strongly agree or somewhat agree that high-quality dog foods are effective for preventive health care, up from 51% in 2014. New product offerings, M&A transactions and overarching trends seen in the Pet Industry continue to be decidedly similar to human consumer trends in food, healthcare and wearable technology.

Within the Food and Treats segments, not only have ingredients and sources in pet food become more scrutinized, but also large players are now competing for market share from pet owners who are treating their dogs and cats to non-GMO, grain-free, raw, supplemental or other fundamental food products. WellPet added more natural and raw food options to its product offering through M&A. By acquiring Sojourner Farms LLC, the company added the Sojos line of homemade, all natural, freeze dried, raw pet food to its healthy and natural brand portfolio. Zuke’s also announced that it will be expanding its treat-based business to include natural dog food. Available in summer 2016, Zuke’s Ascent Natural Dog Food will be…

Click Here to Read the Full Report >